The clinical research industry has seen rapid growth in the last ten years, with North America dominating this industry by a great margin. Clinical research organizations (CRO) are a facet of pharmaceutical research and development (R&D), with a current valuation of $38 billion—expected to reach a whopping $65 billion by the end of 2020. Initially, the R&D departments of the pharmaceutical companies were conducting clinical research and trials internally, however, growing costs and increased regulations have forced these companies to look for smarter alternatives and thus has given rise to the CRO industry.

Following a drastic decline of returns on R&D investment—which fell down to 3.6 percent in 2016—that pharmaceutical companies began outsourcing clinical trials to drive down costs. According to one report, it takes about $2.5 billion to develop a single drug, and only 12 percent of these drugs enter the clinical trial phase. By 2020, it is believed that <href=”#.Vh50c-xVhHx”>more than 70 percent of the clinical research work will be outsourced to these multinational companies, which have now extended their horizons and are helping pharmaceutical companies with pre-clinical evaluations, designs, report management, record tracking, and more.

Segmentation of Clinical Research Market

The clinical research market can broadly be segmented into two parts based on the design and development phase. The development phase segment is further divided into the 4 phases of clinical trials:

- The first phase is focused on testing, which is conducted with a relatively small group of people to identify the side effects of the drug—if any.

- The second phase focuses on testing done on a comparatively large audience to determine the effectiveness of the drug, and whether it is able to resolve or cure a particular issue.

- In the next phase of the trial, Phase 3, the drug is tested on large groups of people and data such as dosage, effectiveness, and possible side effects are documented.

- Finally, the last phase, phase 4, is conducted after the drug has been approved by an organization—like the FDA (Food and Drug Administration) in the United States—and further characteristics of the drug and its long-term effects etc. are monitored and documented.

The majority of cost—about 58-60 percent—is spent on phases 2- 4 with the Phase 1 only requiring about 10 percent.

Market Share and Leader

The CRO market is dominated by North America which holds more than 36 percent of the market share. North America combined with Europe controls approximately 80 percent of the clinical research market.

They are followed by Asia Pacific regions—where countries like Japan, India and China dominate—followed by African regions and then South America. With countries shifting their trial bases to low labor cost areas, such as India and South Korea, Asia Pacific is expected to rise up to the first spot in the near future.

Developments Seen in the Industry

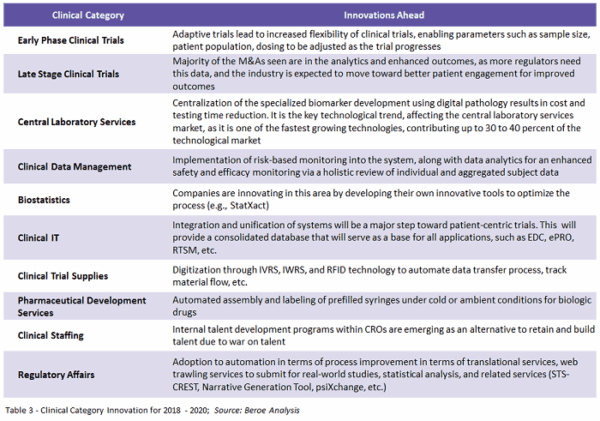

1. Embracing Digitization

Clinical research activity requires capturing a lot of data, which previously generated a lot of paper trails. These paper trails were not only difficult to handle but managing them put additional financial pressure on organizations looking to cut costs. Organizations are now shifting toward digital documentation of clinical trials which can be stored easily and is also a more cost-effective alternative to records maintained on paper. Aside from easing the financial pressure on the pharmaceutical companies, organizations operating within the CRO industry are working to create a global, synchronized database, from which any medical organization or concerned authority can retrieve data.

2. Emerging Regions

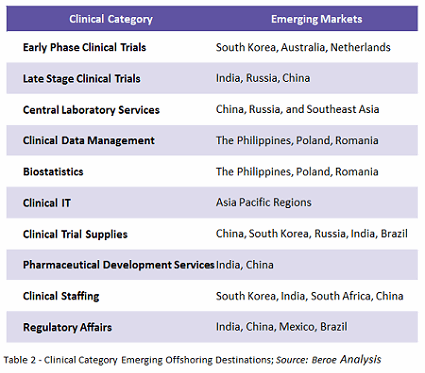

New regions are now emerging as a part of clinical trials and investors and sponsors are encouraging organizations to conduct trials in countries such as India, China, and Korea—where the competition is less and so is the cost per patient.

However, while these investors are able to save costs by shifting from developed nations to developing ones, they are facing challenges such as low trained staff, lack of technology and poor-quality data, which are negatively impacting affecting their trials.

3. A gradual shift towards outsourcing

With a number of factors such as the complex number of trial steps, identification of suitable patient types as well as a tremendous volume of regulations and legislation causing friction—most of the organizations are seeking third-party help. More than 60 percent of pharmaceutical companies have partnered with companies operating in the CRO industry for conducting clinical trials and through this are reducing their R&D cost and focusing on making a profit. The market penetration of the CRO sector has seen an increase of 4 percent in 2017 and is currently at 45 percent—up from 41 percent in 2015.

Developments to Expect

Most sponsors in the industry are currently striving to enhance data quality and adopt a unified approach to capturing and storing data. With emerging trends such as big data as well as blockchain technologyv giving new avenues for storing and maintaining huge data sets, suppliers and providers should focus on data optimization.

The demand for clinical experimentation is going to increase and so is the adoption and inclusion of new regions for conducting clinical research. Though country-specific regulations may stand in the way, local partnerships and partnerships with offshore suppliers can help get past this barrier and push this industry to broader adoption.

- A Complete Introduction to CRM: How Big Is the CRM Market? - March 11, 2019

- Clinical Research Organizations Cut Costs and Streamline Development of New Drugs - November 15, 2018