Intel released their financial results this week. For a company in the process of a long turnaround, those results were impressive. Granted, NVIDIA is being pounded for a revenue miss, but this is a company recovering from self-inflicted wounds during a time of massive world-wide economic uncertainty. In that context, the results weren’t as bad as the market indicates. In fact, they are pretty amazing. (Though missing guidance is always going to be problematic).

Year-over-year growth was strong across all segments with only slight weakness in Accelerated Computing Systems and Graphics, which only grew at 5%. But other growth rates were strong, ranging from a low of 11% for Network and the Edge, to a whopping 54% for foundry services, which would have been amazing in any year let alone a year with massive global logistics problems.

Individual highlights included a strengthening of Intel’s AWS relationship which now includes co-development of AWS’s multi-gen datacenter, Lockheed Martin for 5g for the military, Accenture for AI reference kits for Open-Source users, NVIDIA for NVIDIA’s DXG-H100, and vastly improved supply agreements. And with the likely passage of the Chips Act, Intel is poised to expand its global footprint as it competes with other FABs and helps the U.S. recapture semi-conductor independence, creating resilience against future logistics nightmares.

Let’s talk about Intel’s results this week.

Turning around is painful

I’ve been through several successful turnarounds (and even more that didn’t make it), and they are hard. What makes them particularly hard is that when a company has been run poorly for an extended time, it builds up massive inefficiencies and dead weight that can take years to fully discover, let alone correct, and Intel had around a decade of bad leadership.

People expect the new CEO to immediately right the ship, but it isn’t as simple as steering the tiller into a new course, you must first correct the problems that resulted from the bad management. If Intel was a ship, it would be like the Titanic when Pat Gelsinger took over. Long before he would be able to get the ship moving in the right direction, he needed to stop it from sinking.

Intel is no longer sinking, and its financials indicate it’s building steam for a better future. But expectations still seem to be a bit unreasonable when it comes to movement, particularly given the supply chain and pandemic issues which have badly hurt the entire industry’s ability to execute.

Intel’s moves with the U.S. CHIPS (Creating Helpful Incentives to Produce Semiconductors) and Science Act were brilliant because they reaffirmed Intel’s image of leadership and put it on course to potentially have the largest semiconductor manufacturing capacity in the world. This will pay huge dividends to both Intel and the U.S. once the relevant FABs are up and running. The build-up will take a significant portion of this decade to accomplish but, once done, should re-establish Intel at the top of the semiconductor food chain.

Interesting bits

One of the most interesting parts of this financial report was the renewed relationship with AWS. AWS has been designing its own processor for cloud loads and, generally, companies prefer technology they’ve developed over that acquired from a company like Intel. But AWS appears to have again embraced Intel which should reduce the risk of that AWS processor.

Intel also competes with ARM and NVIDIA is a huge ARM supporter, nearly buying that company earlier this year. NVIDIA’s use of Intel technology for the CPU of its strategic AI DGX-H100 platform indicates that even NVIDIA believes that Intel’s technology is better for some forward-looking, high-performance platforms. Given NVIDIA has not been an Intel fan, its use of Intel technology in one of its strategic platforms is a clear indicator that Intel’s technology is again competitive.

Wrapping up: Intel is coming back

While it hasn’t happened yet nor is it happening fast, turn-arounds take time. These financial results and strategic partnerships are an indicator that Intel is getting better, executing strongly, and that by the second half of the decade it will once again be the semiconductor company that overshadows all others. The credit goes to Pat Gelsinger and his team who continue to exceed expectations and showcase that with passion, heart and perseverance, companies can recover and again be a competitive force to be reckoned with.

Or, back to that Titanic analogy, it’s like Intel flew in a new captain who fixed the leaks and improved the ship to a point where it was better than it had been before it hit the iceberg. Intel is on track to eclipse what it was before its prior CEO. That’s good news for Intel and for the country.

- CES 2026: The Year AI Got Real, Lenovo Owned the Vision, and Memory Prices Broke the Bank - January 13, 2026

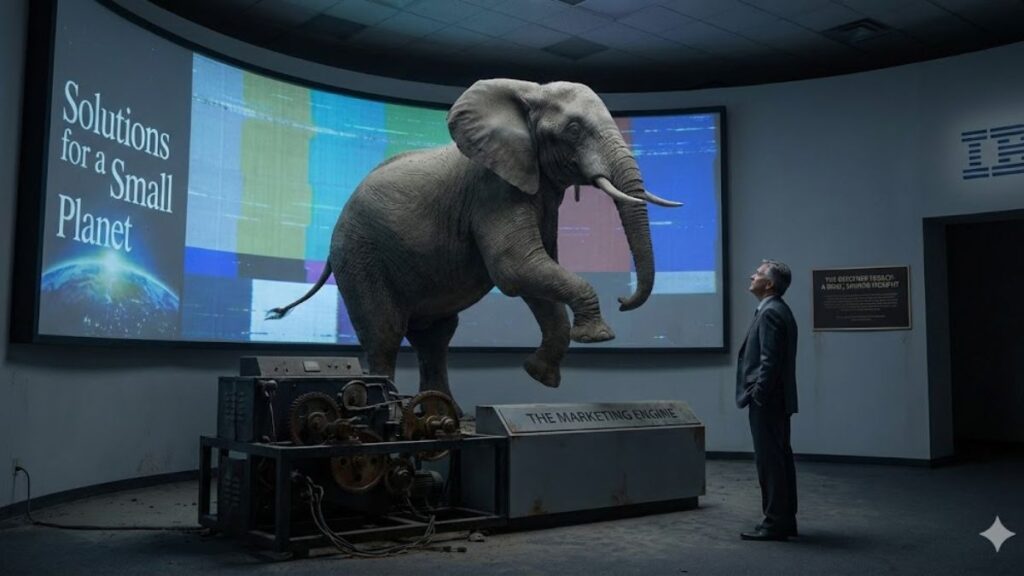

- The Gerstner Legacy: How Marketing Saved IBM and Why Tech Keeps Forgetting It - January 2, 2026

- The Silicon Manhattan Project: China’s Atomic Gamble for AI Supremacy - December 28, 2025